Vehicle registration process

All vehicles must be registered in their country of operation, in compliance with local law.

Vehicles (and larger generators) must be registered and insured before they can be considered operational. The registration process depends on the circumstances in which the vehicle arrives in the operation:

- The vehicle is imported new, with no previous registration records.

- The vehicle comes with export plates from the country of dispatch (which may or may not be the country of origin). Export plates usually have limited validity.

- The vehicle is still fully registered in the country of dispatch.

- The vehicle is already deregistered in the country of dispatch.

- The vehicle is registered in a third country.

Import procedures must usually be completed and the vehicle must be customs cleared before it can be registered. In addition to the customs clearance certificate, the below documents will be required:

- invoice

- packing list

- certificate of origin

- vehicle gift certificate (if applicable).

Only a partner with legal status in the country of operation can register a vehicle in their name. Therefore, vehicles used in an operation will usually be registered under the name of the or the , unless collaborating have legal status in the country of operation.

Note: generators and handling equipment do not usually require registration but this can vary between countries.

Insurance

Only a partner with legal status in country of operation can subscribe to an insurance policy. Therefore, vehicles used in an operation will usually be insured under the name of the or the , unless collaborating have legal status in the country of operation.

Vehicles rented through the (see the section on the IFRC vehicle rental programme) will be included in the IFRC global insurance policy, but additional insurance policies must be subscribed to locally, as applicable (these are usually third-party, theft and accident).

Refer to the VRP agreement for more details on insurance claims and payable excesses.

A Federation operation may register vehicles for insurance on behalf of a PNS under the following conditions:

- A fixed asset registration form is submitted and IFRC operation obtains approval from global fleet base.

- The PNS signs an integration agreement with the operation.

- The PNS agrees to respect the IFRC’s standard operating procedure, as laid out in the IFRC fleet manual.

- All PNS drivers are tested and sign the operation’s driving rules and regulations.

- Only drivers with a valid authorisation issued by the head of the IFRC operation may drive the vehicles.

Note: vehicles owned by a PNS and registered under the IFRC are subsequently covered by all IFRC insurance policies.

Tracking vehicle and generator use

For accountability and safety purposes, the use of fleet in an operation must be monitored. It is recommended that regular training is conducted, with refresher training for fleet users and spot checks on the correct use of logbooks.

Vehicle logbooks

Every vehicle operated by the British Red Cross, including rented vehicles, must have an allocated vehicle logbook to monitor the use of the vehicle, refuelling and maintenance.

Every movement of the vehicle must be captured in the logbook, which is an auditable document.

Every entry in the logbook must be signed by the driver (for refuelling), the passenger (for trips) or the fleet manager (for maintenance services).

Where vehicle costs are charged to specific cost codes or programmes, these must be recorded in the logbook, with the passenger or cargo details.

Note: when cargo is transported, reference must be made in the logbook to the waybill associated with the load transported.

Generator and handling equipment logbooks

The use of generators and other handling equipment such as forklifts must also be monitored and auditable. Running hours must be captured in a logbook. Details to be included in the generator and handling equipment logbook include:

- every period of usage (running hours) – signed off by the user in charge

- refuelling – signed off by the person in charge

- maintenance services – signed off by the fleet manager or mechanic (as applicable).

The generator (or equipment) handbook must be controlled by the logistics lead at regular, pre-agreed intervals. The logistics lead should sign or initial pages after each regular check.

Generators and handling equipment should normally be allocated to a specific cost code or programme. Where that is not the case, details of the recharge must be indicated on the logbook.

Safety and security

General vehicle safety

Fleet procedures and road safety policies are in place to ensure maximum security for drivers, passengers, and vehicles, and must be adhered to.

All vehicles must be mechanically sound and roadworthy. Fuel, tyres (including the spare), water, coolant, brake fluid, steering fluid and oil levels must be checked regularly.

Refuelling should be optimised so that a vehicle’s tank is always at least half full.

Depending on context, all vehicles should be equipped with communication equipment, emergency repair materials (spare tyres, jump leads, vehicle jacks), passenger safety equipment (safety belt, drinking water), accident preparedness equipment (first aid kit, fire extinguisher, list of contact numbers). All vehicles must be equipped with Red Cross markings, including emblem and no weapons sign.

As per the Asset maintenance section, inspection and maintenance must be planned, conducted, and documented, in order to ensure that vehicles and generators are safe and efficient.

The driver of a vehicle is responsible for checking the condition of their vehicle and all necessary equipment in the vehicle, while the facilities manager is responsible for checking the condition of generators.

View a list of elements that make up a good driver here.

Using generators safely

Where generators are used as back-up power or a primary power supply system, the below recommendations will ensure safe usage of the units.

Generator sheds (see the example design below) are recommended to limit access to the generator and protect humans and animals. It also ensures that only one person oversees the maintenance of the generator.

- Distance between the top of generator and the ceiling is a minimum of 1.5 metres to ensure good ventilation and access for maintenance. Around one metre is required around the generators and between two generators.

- There is a well-secured area with a lockable gate, blocked from weeds growing in but sufficiently open to let gas escape.

- There are enough openings in the structure to allow good ventilation, both at the bottom and the top.

- There is sufficient space for the storage of oil, funnels etc. Fuel should not be stored in the generator room/shed.

- There is an exhaust outside the structure, protected from rain and a straight pipe without sharp angles.

- There is firefighting equipment – an ABC-type fire extinguisher and a bucket of sand with a shovel as a minimum.

Generator safety basics:

Set-up

- Ensure the ground (or preferably the concrete foundation) is strong enough to hold the weight of the generator.

- Elevate the generator by 10–20cm above the ground to prevent it from flooding.

- In very hot conditions, generators might overheat. A running schedule should be used to allow the generator to cool down. Do not open the doors of the generators while it is running, as this disables the cooling function.

Usage

- Do not daisy chain extension cables, as they will melt.

- Do not overload the generator by connecting too many appliances at the same time. See appliances’ kVa rates table in the Power supply section.

- Make sure a grounding pin is properly installed to the generator, and that all the cables and appliances have a connection with grounding.

ICRC convoy procedures

When operating in the field, the and other Movement partners often travel in convoys. Because of the nature of ICRC operations, unarmed and in conflict situations, humanitarian personnel often travel in a group of vehicles, for protection purposes. The head of delegation decides in what situations this is necessary.

The aim of the ICRC Convoy Procedure document is to provide guidelines to staff organising or joining convoys. The list of responsibilities is designed to help conveyors and drivers in the field, before, during and after a convoy.

British Red Cross driving procedure

The British Red Cross has a Driving in the British Red Cross policy that must be adhered to when driving a British Red Cross vehicle in the UK.

When driving a British Red Cross vehicle outside the UK, the agency with security lead (the , or ) provides driver regulations. It is the responsibility of every British Red Cross delegate to enquire about applicable driver regulations when joining a Red Cross operation.

Provided that they have passed the driving test and hold an official driving license, delegates may be allowed to use vehicles for personal use. However, rules applying to the personal use of vehicles will vary depending on the context of the operation, and advice should be sought from the IFRC or the HNS.

In some operations, the personal use of fuel will be recharged to delegates.

Note: logbooks must be kept up to date for personal as well as professional use.

IFRC driver rules and regulations

All personnel deployed within the must read and sign a copy of the operation’s driver rules and regulations form before they are authorised to drive a Federation vehicle.

The form sets out both country-specific rules and standard operating procedure for the use of Federation vehicles. A signed copy of the form will be kept in the staff member’s personnel file.

The default position on IFRC and other Red Cross missions is that delegates are not allowed to drive themselves, unless the country-specific driver rules and regulations allow it. Medical evacuations and security situations are treated as exceptions to that position.

The standard driver rules and regulations form must be adjusted to reflect country-specific conditions. The head of operation for a Federation operation, the head of project for a operation or the secretary general for a National Society operation determines the country-specific rules concerning vehicle use (for example, conditions for and limitations on delegate driving, mission order procedures, country-specific security regulations, etc).

The fleet manager or delegated authority must ensure that all vehicle users are aware of Federation procedures and country-specific rules, as well as local driving regulations and conditions.

All drivers, including delegates, must have a valid driver authorisation form, signed by the head of operation and the fleet manager, before they are permitted to drive a Federation vehicle. The authorisation must specify the types of vehicles permitted and any limitations on their use.

Note: passengers are restricted to National Society personnel (volunteers and staff), IFRC and staff. Members of UN agencies and other NGOs are permitted as passengers, as long as travel is within the scope of the Movement’s activities. Transporting other passengers or cargo is not allowed, except with previous authorisation from the IFRC country representative or staff in charge of managing local security (for example, programme manager, ops lead, etc).

All drivers, including delegates, must undertake a test of driving ability in their country of station or deployment.

British Red Cross safety training pathway

Refer to the Safety training pathway section in the Warehousing chapter.

Planning for usage

A well-sized fleet should aim for maximum usage, with minimum “idle” time and maximum availability for requests, with minimum service interruption or “down-time”.

Requesting a vehicle and cost recharge

To ensure vehicles are consistently available and sufficient for an operation’s needs, with a minimum number of vehicles underused, a request system that is as simple as possible and as complex as necessary will be helpful.

There are multiple ways in which users can request vehicles:

Vehicle whiteboard – used on a daily basis, listing all available vehicles. Requestors write their name and department on the whiteboard, with trip details (destination, departure time, number of passengers, estimated duration).

Vehicle requests should ideally be recorded at the end of the week for the next week, with an agreed level of flexibility for unforeseen circumstances.

Vehicle request form – submitted to the fleet manager or dispatcher within an agreed timeframe before the vehicle is needed.

Cargo transport request form – for the transportation of goods within an authorised area.

If the transport request is to locations outside of the authorised area, it should be accompanied by a mission order.

These methods are applicable to cases where vehicles are needed for local movements on a single day. Longer trips outside of the operating area or multiple-day trips must typically be approved through a field trip form or mission order, which requires sign-off from line manager, fleet manager and potentially the security manager (depending on context).

Vehicles are usually managed as a pool by the logistics department. Other departments can request to use vehicles, usually on a daily basis, and their usage can be recharged to the requestor through the pool management system.

Vehicles can also be fully allocated to a specific budget, with all costs related to them, including driver, fuel, maintenance and insurance, charged to that budget.

Note: logistics usually has budget to cover fleet maintenance costs, but unusual maintenance services can be charged to requesting departments as applicable.

Fleet productivity: utilisation and performance

In order to review the size of the fleet, monitor usage and report on fleet performance, it is recommended to track productivity in different dimensions.

Fleet performance can be measured looking at:

- Utilisation – resource used (number of vehicles used over period) divided by the available resource (total number of vehicles available over the period). Expressed as a percentage:

No. of vehicles used over the period ÷ total no. of vehicles available over the period = fleet utilisation as a percentage.

- Performance – actual tonnage (or passengers) moved divided by total tonnage (or passenger space) available in a period. Expressed as a percentage:

Tons transported over the period ÷ total tons available to transport over the period= fleet performance as a percentage.

Vehicles’ performance can be measured looking at:

- Utilisation – number of days/hours used divided by the total number of days/hours in a period. Expressed as a percentage:

No. of days or hours vehicles was used over the period ÷ total number of hours or days in the period = vehicle utilisation as a percentage.

- Performance – number of days available for used/total number of days in a period. Expressed as a percentage:

No. of days in the period that the vehicle was available ÷ total no. of days in the period = vehicle performance as a percentage.

Note: where the vehicle’s performance is <80 per cent, the vehicle is not performing well enough and should either be replaced or given a revision.

- Downtime: days that a given vehicle is not available for operations, due to planned or unplanned maintenance (ideally the split between planned and unplanned should be detailed).

Where no logistics staff are available, country representatives/delegates should seek support from , or logistics coordinators to compile the fleet performance data.

For more details on reporting for fleet, see the Reporting on fleet section.

Read the next section on Managing fleet here.

Related resources

Download useful tools and templates here

Download the full section here.

Available to download here.

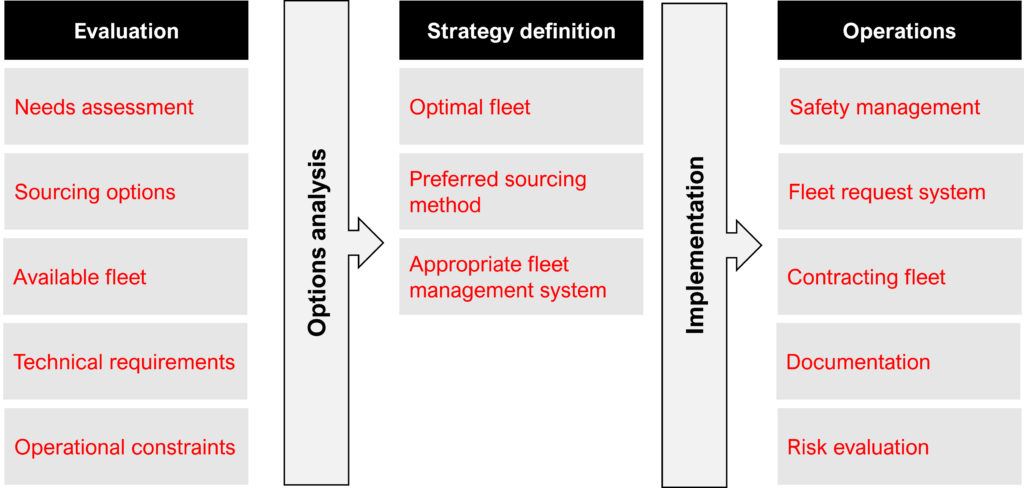

Note: operational constraints include security context and regulations that may apply (import options, labour law, etc).

Vehicles

The number and type of vehicles should always be aligned to the operational needs and conditions, including security, terrain, and team movement patterns. Operational fleet decisions must be compliant with safety and security guidelines (as stated in the IFRC Fleet Manual), with any deviation requiring approval from .

The vehicles selected must comply with IFRC standards, unless approval for the use of non-standard vehicles has been obtained from UKO.

When selecting vehicles, consideration should be given to the following factors:

- local terrain and topography

- state of road and traffic infrastructure

- need for specific equipment, such as in-vehicle communications equipment, a tow-bar or winching equipment, or use of the vehicle as ambulance

- import and export regulations

- local driver capacity (automatic or manual driving, 4×4 driving, left or right-hand drive)

- distance to be travelled and estimated usage (frequency, payload, etc)

- compatibility with existing fleet composition

- local and national service/maintenance and the availability of spare parts

- local rules and regulations, including emission regulations (not all IFRC-standard vehicles meet current emission levels for all countries)

- climate, including seasonal change.

The IFRC standard products catalogue contains full technical specifications of Federation-standard vehicles.

The key point for organising fleet is knowing what the needs are for the programmes in the country office (including any sub-delegations) and for general operations. It is the role of logistics to analyse these needs and then optimise the fleet. This, combined with the national regulations (i.e. load limits for trucks) and the limitations of the surrounding area (i.e. infrastructure) will provide the necessary information to choose the most effective set-up of fleet.

Defining the number and type of vehicles depends on the volume of the workload and the material or number of passengers to be transported, as well as the distance and terrain covered.

The below table will help define the type of equipment needed in operations. To help calculate the number required of each type of vehicle, see Annex 9.1, vehicle set-up evaluation in the ICRC fleet management manual.

| Consider | Criteria | Decisions |

|---|---|---|

| Type of terrain | Town/country/topography Paved/dirt roads Seasonality Warehouse Construction site | Cars, high-range 4x4, low-range 4x4, engine power Specifications of vehicles Tyres, sand plates, motorbikes, etc. Forklift Digger |

| Transport capacity | Bridge and road weight restrictions Local/international distribution Transport of passengers/cargo | Light trucks Trucks Bus |

| Radius of operation | Vehicle fuel capacity and reliability Number and type of vehicles Typical and exceptional journey durations Fuel quality and quantity in area of operation | Refuelling options, linked to typical and exceptional journeys (mileage and duration) Fuel sourcing strategy Storage on site |

| Availability of electricity | Power for all operations Security | Generators vs city power |

Each department has its own needs in terms of type and number of vehicles to add to the fleet list. For example:

- Administration may require cars for errands or official visits.

- Programme teams may need light 4×4 vehicles for field visits and transfers.

- Construction and warehousing teams may need pick-ups for equipment.

- Teams in charge of distribution (usually called relief team) will need trucks.

Combining and analysing these needs into a summary table will help constitute the fleet (in number and type), in a way that meets the needs of each team and minimises the cost of operation. The vehicle pool system (see the Requesting a vehicle and cost recharge section of Vehicle usage) should be considered, as it maximises vehicle utilisation through avoiding the taking of vehicles without justification.

| Team 1 | Team 2 | Team 3 | Team 4 | Team 5 | Total | |

|---|---|---|---|---|---|---|

| Vehicle type 1 | ||||||

| Vehicle type 2 | ||||||

| Vehicle type 3 | ||||||

| Vehicle type 4 | ||||||

| Total |

Available to download here.

Power supply

Generators must be set up and maintained by qualified staff – a mechanic or a head driver. Support is always available from locally available staff from other , or or from -based logisticians.

Note: specialist skills are required to manage generators. Staff involved in plant management processes must be trained electricians or experienced logisticians.

The output of a generator is measured in KvA (kilovolt-ampere) and volts. They can be air or water-cooled and can be soundproofed (silent) or not. Generators are either petrol or diesel-powered.

The British Red Cross uses hybrid generators when deploying their logistics or Emergency Response Unit teams (see the ERUs chapter for more details on the ERUs). These provide standard power generation and simultaneously charge a set of batteries, which can be used to provide power once the generator is turned off. The batteries’ power demand must therefore be included in the load calculations. Details of the generator specifications as well as a user manual are available from the international logistics team upon request and provided to the teams when they deploy.

It is important to match the power generated to your electrical needs as closely as possible: if the load is too high, the generator will stop and be damaged. But when the generator is supplying less than 40–50 per cent of its power capacity, fuel consumption increases, the lubricant deteriorates more quickly, and the engine’s life cycle is reduced.

Without any power demand to it, a generator will typically already be using 25-30 per cent of its rated power.

| Scenario | Impact on generator set | |

|---|---|---|

| A | Power demand is less than 40–50% of the maximum rated power | Fuel consumption increases Generator life cycle is reduced Lubricant deteriorates more quickly |

| B | Power demand is between 60–80% of maximum rated power | Optimal use of the generator |

| C | Power demand is more than 80% of the maximum rated power | Fuel consumption increases (but less than in Scenario A) |

| D | Power demand is more than 100% of the maximum rated power | Generator stops Generator life cycle is reduced |

Available to download here.

It is a good idea to have batteries as part of an electricity provision setup, so that they can be charged while the generator is turned on. Critical appliances (communication systems, fridges, alarm and/or security systems) can then work in case neither city power nor the generator can supply power. If the generator is used to charge batteries, make sure their rated kVA is calculated into the total power requirements.

To calculate your power supply needs and to choose the right generator, use the power calculator table. The generator size (in kVA) must be equal to or greater than the total consumption of all appliances. The higher starting requirement must be considered when calculating the generator size.

| Consider | Criteria | Decisions |

|---|---|---|

| Electrical load | Total load calculations Power (kVA) Local voltage and frequency | Reduce requirements? Alternate generators? (consider whether budget can cover duplicate setup) |

| Expected usage | Permanent/back-up system Consider requirement for UPS by way of back-up Starting system (manual/electric/automatic) | Alternate generators if constant power supply needed Establish running hours with regular breaks (consider if budget can cover duplicate setup) |

| Make, brand, place of manufacture | Local availability and quality of relevant fuel and parts Local maintenance capacity | Budget for fuel and spare parts |

| Geographical area of use | Altitude Temperature and weather conditions Exhaust emission regulations Cooling system (air/water) | Improve electrical safety at location Isolate generator appropriately (consider budget availability) |

| Place of use | Indoors/outdoors Ventilation Protection from elements Noise and disruption Type (portable/fixed/on trailer) Safety | Budget for generator shelter or noise reduction system Require inspection of terrain Security requirements How to earth it effectively? |

| Price | Budget, set-up costs, maintenance costs | Within budget/out of budget |

Available to download here.

Fleet options and modalities

The ’s aim regarding fleet management is to standardise fleet as much as possible, allowing for easier tracking, resource-sharing, and maintenance management. It also allows different parts of the Movement to benefit from competitive pricing from manufacturers.

Vehicles outside the list of standard fleet should only be purchased after approval from a centralised fleet management team (usually HQ logistics, or ).

The IFRC standard products catalogue and include the list of standard vehicles.

Fleet to be used in field operations should always be procured centrally and through the existing agreements with manufacturers.

Where fleet is being procured locally and only for city use, the following criteria should be adhered to as much as possible:

- Make – well-known European or Japanese make, well represented in country of operation.

- Category – city car (Peugeot 208, Toyota Corolla or equivalent), not necessarily a station wagon.

- Engine power – maximum 100 hp or 75 kw.

- On-board security – Alarm/immobiliser, antilock braking system (ABS), electronics stability control and air bag if available.

- Fuel – diesel or petrol (check regulations, availability and consider the environmental impact).

- Pollution control – optimum, but at least as per local regulation.

- Transmission – two-wheel drive, preferably automatic – unless road conditions in the city require four-wheel drive.

- Colour – preferably white, and a light colour if not available – should not clash with Movement visibility.

- Budget – equivalent to the cost of standard vehicles.

- Maintenance – access to local maintenance without HQ support.

Standardisation and compliance to environmental regulations should also be applied to the choice of generators. In general, ensure that the brand is well-established, that fuel type matches local fuel availability and that spare parts and maintenance are widely available.

Different types of fleet sourcing solutions

British Red Cross own fleet

In this option, the British Red Cross purchases the vehicles and uses them for its operations.

The decision of what vehicles and how many to buy will be based on operational needs and the procurement must be controlled and managed through . Such vehicles would be purchased and imported under the and the British Red Cross would donate the vehicles to them once the British Red Cross-supported programme ends.

This option would usually only be considered when:

- it represents better value for money than other options, such as using the ’s system

- vehicles are required for more than two years

- there is assurance that the donation does not place an unnecessary burden on the HNS in terms of maintenance and cost.

In these cases, the British Red Cross usually covers all the costs associated with the vehicles, including maintenance, drivers’ charges including per diems, local insurance, registration and fuel.

The maintenance of British Red Cross-purchased vehicles outside the UK is done following the IFRC maintenance guidelines, unless it is agreed that the vehicle is managed under the ‘ fleet management procedures.

Commercial rentals

Renting vehicles or outsourcing their maintenance can be a requirement for an operation either temporarily (during a short-term surge in activity) or as a long-term solution (where ownership is not an option).

If renting vehicles, the applicable procurement procedure should be followed. The selected rental company must be reputable and offer value for money. See the Sourcing for procurement section for more details.

IFRC vehicle rental programme

For step-by-step guidance on sourcing vehicles through the , refer to the VRP service request management/business process document.

The vehicle rental programme

The International Federation’s vehicle rental programme (VRP) was established in 1997 to ensure a cost-effective use of vehicles and fleet resources. Revised in 2004, it continues to be an effective means of providing vehicles to International Federation and National Society operations. The programme is run as a not-for-profit service within the International Federation; monthly vehicle rental charges are calculated to cover the vehicles and the operating costs of the VRP.

Depending on the estimated period of vehicles’ requirement, it may be cheaper or more straightforward to rent them through the VRP, but a full cost comparison should be done before a decision is made. Cost comparison must cover the cost of the vehicle, shipping, registration, insurance and local insurance, maintenance and PSR of 6.5 per cent.

The overall aim of the VRP is to provide good-quality vehicles as quickly as possible, and with maximum bulk discount. It also enhances standardisation, centralises control and minimises costs, through end-of-lease sale. Vehicles on this programme are managed through the fleet base in Dubai and remain the property of the . All leases must be organised through the IFRC.

The vehicle rental programme is managed through the global fleet base in Dubai, but a lot of the fleet management team’s responsibilities are delegated regionally and implemented through regional fleet coordinators in the Operational Logistics procurement and supply chain management units (OLPSCM, also known as Regional Logistics Units).

Note: monthly VRP invoices are processed through .

The VRP agreement is materialised through a vehicle request form, which must be signed off by the British Red Cross country manager and submitted to the global logistics service (GLS) team in Dubai.

Global fleet base vs regional units: roles and responsibilities

VRP system – roles and responsibilities are as follows:

Global fleet unit (Dubai)

- overall management (operational and financial)

- maintaining the VRP business plan

- procurement hub for vehicles and vehicle-related items

- managing all incoming requests for dispatch and allocation of new and used vehicles

- supporting disposal of VRP vehicles

- preparing vehicles for deployment (technical assessment and repairs).

Regional fleet coordinators (in )

- implementation and maintenance of standards at a regional level

- advise on the implementation of preventative maintenance and repairs to maximise lifespan and usage of regional fleet

- coordinate movement of fleet across the region

- supporting planning of transportation needs in the region

- implementing standard asset disposal procedures

- ensuring proper maintenance of fleet wave database and analysing data

- reporting on regional fleet usage to global fleet base

- maintaining regional fleet files

- advise and train on fleet sizing, fleet management and VRP

- managing regional IFRC fleet.

VRP rental costs

To encourage forward planning, cost incentives have been built into the . Rental rates are based on a sliding scale, in which longer rentals benefit from cost savings (i.e. a sliding scale, based on the duration of the contract).

| Model | Five-year average monthly cost (CHF) | 12-month average monthly cost (CHF) |

|---|---|---|

| Toyota Land Cruiser HZJ78 | 720 | 830 |

| Toyota Land Cruiser pick-up double cabin HZJ79 | 671 | 775 |

| Toyota Land Cruiser pick-up single cabin HZJ79 | 650 | 750 |

| Toyota Land Cruiser SWB HZJ76 | 736 | 850 |

| Toyota Land Cruiser Prado LJ150 | 696 | 800 |

| Toyota Corolla ZZE142 | 635 | TBC |

| Toyota Hiace minibus LH202 | 621 | 715 |

| Nissan Navara pick-up double cabin | 546 | 630 |

Available to download here.

These rates are indicative and may change – quotes can be requested from the global fleet team when considering renting vehicles through the VRP. The latest version of the rate sheet is available here.

An additional 6.5 per cent programme support recovery cost must be added to the total cost of the contract with the VRP, as well as delivery and return shipping costs (including any applicable import duties).

VRP system – cost structure

Included in VRP rental rate

- global third-party liability insurance cover (up to CHF 10 million)

- full vehicle damage insurance (including a replacement vehicle)

- vehicle replaced at the end of its lifetime

- fleet management support

- accident insurance for driver and passengers

- specialist driver training (depending on context and availability of funding)

- access to a web-based fleet management system.

Not included in VRP rental rate

- telecom equipment ordered by the operation

- additional equipment: snow chains, spare part kits, roof rack

- all charges linked to the delivery of a vehicle: shipping, in-county transport, customs duties, taxes for import, port and warehouse charges, etc

- all in-country charges: registration, vehicle insurance, local third-party liability insurance, etc

- all operating costs, including fuel, maintenance and repairs

- all charges linked to the return of the vehicle to a VRP stock centre or secondary destination (as requested by global fleet base): customs duties and taxes for re-export, cost to deregister the vehicle in-country, transportation, port and warehouse charges, etc.

- any costs for additional repairs resulting from the loss of or improper documentation relating to a vehicle’s maintenance history

- any costs for additional repairs at the end of the rental period, for damage considered beyond the normal wear and tear.

Using another National Society’s vehicles

Most National Societies (NS) use a mileage rate that they charge for the use of their vehicles by Partner National Societies (PNS). Alternatively, they may charge a monthly fee or let PNS use their vehicles and only charge them the cost of fuel.

Mileage rates and what they include often differ, and it is recommended to clarify what is covered (fuel, driver costs, maintenance, etc), and how the amounts to be recharged will be calculated.

Choosing the best vehicle ownership solution

British Red Cross owned vehicles

Benefits for British Red Cross

- Vehicles belong to British Red Cross.

- At the end of a project, these can be disposed and realise residual value.

- British Red Cross is free to donate these vehicles to any partner of choice after the end of a project or five years.

Risks for British Red Cross

- British Red Cross must source the vehicles and ship to operation where required.

- Some governments force international organisations to donate vehicles to their governments at the end of a project.

- Vehicle must be managed as an asset (including depreciation).

- British Red Cross must spend large sum to buy the vehicles outright.

- If mission is cancelled or discontinued at short notice, British Red Cross is stuck with these vehicles.

- It is difficult to increase/reduce fleet size at short notice, but surge option plans can be built in.

- Donor constraints on expenditure.

IFRC’s vehicle rental programme

Benefits for British Red Cross

- Monthly vehicles rental cost is known, so easy for budgeting purposes.

- Access to standard vehicles.

- There is good scalability of fleet.

- Vehicles comprehensively insured at global level by IFRC.

- IFRC will replace vehicles after 150,000km or five years, whichever comes first (in-country costs associated to vehicle change will need to be covered by the requesting , but all other costs covered by ).

- IFRC will provide fleet management support, including cost tracking and driver training.

- There is no cost of disposal.

Risks for British Red Cross

- Solution includes shipping the vehicle into operation area and shipping out after the end of the lease, which can delay the availability of the vehicle to the operation.

- After five years, vehicle still belongs to IFRC and British Red Cross cannot donate it to partners.

- It can be expensive in the short term, considering shipping costs into and out of operational area.

- IFRC will charge a programme support recovery fee.

Local vehicle rental

Benefits for British Red Cross

- Locally available and no importation costs or delays.

- It is easy to scale up or down.

- It is easy to arrange at short notice.

- It supports the local market.

- Budgeting is easier when rates (including maintenance and service) are fixed.

- There is no need to have own maintenance facilities or resources.

Risks for British Red Cross

- Rental rates can be very high.

- There may be a maximum mileage under the rental scheme.

- Locally available vehicles may not be of a good standard.

- Local maintenance practices may not be safe.

- The right vehicles are not always locally available.

- Renting vehicles from questionable business people could result in bad reputation by association. Consult international sanctions lists before entering a lease agreement.

Using other National Societies’ vehicles

Benefits for British Red Cross

- Vehicles are readily available and easy to scale down.

- It gives support to movement partner.

Risks for British Red Cross

- It is not always easy to scale up (they might not have enough vehicles).

- It is only possible with small requirements.

- Vehicles are not always of a good standard.

- British Red Cross can only use what the partner has excess of or does not require.

Read the next section on Resourcing for fleet management here.

Related resources

Download useful tools and templates here

Download the full section here.

Due to the variety of ways of working within the British Red Cross, the responsibility of procuring, maintaining, reporting, and disposing of assets may lie with different parties.

The standard types of relationships are listed below, indicating respective responsibilities.

Note: HNS refers to Host National Society, PNS to Partner National Society and NS to National Society.

| Procurement | Maintenance | Reporting | Disposal | |

|---|---|---|---|---|

| Bilateral GAD (Grant Agreement Document) | HNS purchases with BRC funds sent via a GAD | HNS plans and tracks | HNS submits to the BRC | HNS submits disposal plan and sign-off request to BRC |

| Indirect GAD* | PNS purchases per GAD terms (specifies procurement policy). PNS owns asset | HNS plans and tracks | HNS submits to PNS | PNS submits disposal plan and sign-off request to BRC (unless GAD specifies otherwise) |

| BRC procurement support to (P)NS No GAD needed | BRC procures with BRC funds and donates to NS | NS per internal requirements | NS per internal requirements (report to BRC only required, if specified) | NS per internal requirements (disposal plan/sign-off form to BRC only required, if specified) |

| BRC asset for BRC use | BRC UK team | BRC UK team | Per BRC requirements | Can be donated individually if standalone items, or via disposal plan and sign-off request if at end of programme |

*When British Red Cross partners with a PNS who implements with a HNS

Available to download here.

Note: partnerships with and/or normally follow IFRC/ICRC asset disposal procedures.

Read the next chapter on Fleet here.

Download the full section here.

When closing down an office, operation or programme, all assets should be allocated a disposal option in an asset disposal plan that forms part of an overall exit plan of action.

The selection of options through the asset disposal plan is the responsibility of the budget holder (programme manager or country manager), implementation of the disposal plan is delegated to Logistics.

In order of preference, assets that need to be disposed of should be:

- Donated to the

- Donated to another RC Movement partner

- Donated to a partner

- Donated to another humanitarian organisation

- Sold

- Destroyed

Separate to these options, the option to export the asset back to the UK for further use should always be considered, based on the type of item, value and relevance in the local context. Consult the Logistics Coordinators to enquire about the relevance of returning an asset to the UK.

The budget holder must select the best option from the above list when creating the asset disposal plan.

The asset manager is responsible for managing the asset disposal process following the matrix in the Donating an asset to other organisations section of Asset donations. However, accountability for the process lies with the budget holder who must initiate the process, make the relevant decisions about each asset’s disposal and ensure all steps are followed properly through to sign-off of the disposal plan.

Designing the disposal plan:

Task:

- Confirm and compile list of assets and high-value stock as part of the exit plan of action (refer to the updated asset register).

Method:

- Physical check.

- Use the list to update status as the disposal process progresses.

- Propose list to for validation.

- The list must include damaged items and those that have already been pledged (which should be marked as such).

- The list must indicate purchase value, current depreciated value and donor codes.

Task:

- Consider donor/government requirements.

Method:

- Obtain guidance from donor and local government on asset disposal.

Task:

- Consider return, transfer or disposal options.

Method:

Committee at UKO to be constituted (can include members from logistics, finance, IT and programme team and donor representation) to agree disposal route:

- export to return to UK

- transfer to other programme locally (British Red Cross, HNS, consortium)

- donation

- sale

- destruction

- committee to consider donor requirements, Value for money, repair options and costs, on-going maintenance/running costs (potentially impacting the HNS adversely) and cost of repatriation (including carbon footprint analysis).

Implementing the disposal plan:

Task:

- Donation to HNS, , or other NGO. Note: donation to staff is strictly prohibited.

Method:

- Communicate the asset list to organisations to see if anything within the list is needed for their programme.

- British Red Cross need to ensure that assets will be used and should consider what other PNS will do to reduce the risk of overwhelming the HNS with assets.

- Confirm with local legal advisor that there is no problem transferring assets under the IFRC Integration Agreement.

- Donation certificate will be required.

Task:

- Sale.

Method:

- Bill of sale must be raised, signed by each party.

- Depending on quantity of items to be sold, consider contracting a company to manage the sale.

- Tax implications of sale must be carefully researched.

- Proceeds of the sale must adhere to donor requirements.

Task:

- Destruction.

Method:

- Consider local environmental law and associated costs and requirements (especially for dangerous goods and fluids).

- Consider contracting recycling companies and associated costs and donor requirements.

Task:

- Export back to UK.

Method:

- Costs must be investigated and approved by UKO committee.

Reporting losses: all lost or stolen assets should be recorded on the frauds and losses register as they occur. British Red Cross requires all asset losses to be reported through Datix incident management system.

Damaged assets must be identified as such – logistics must be consulted on repair options and arrange for agreed repairs.

The overall exit plan of action, and the asset disposal plan in particular, must be signed off according to the total value (that is, the purchase value, not the depreciated value) of the portfolio of items/assets being disposed of following the thresholds listed below and signed off in the if there is one.

| Donation amount | Approved by |

|---|---|

| Up to £50,000 | Budget holder (e.g. Programme/Country Manager) + Finance |

| Up to £100,000 | Head of department/head of region (LogCo consulted) |

| Up to £1,000,000 | Programmes & Partnership Director international |

| Up to £5,000,000 | Executive Director International |

| Above £5,000,000 | CEO and CFO (ELT informed) |

Note: regardless of the total value of the asset disposal plan, it is critical that the budget holder (programme manager or country manager) is informed at all stages of development of the plan.

Note: the sequence of approvals is important for asset disposal plans:

- if there is one

- BRC per the above table

- donor

Once the asset disposal plan has been finalised, it should be circulated to the designated approvers, together with an asset disposal plan sign-off form.

Disposal by donation

The preferred option for disposing of surplus stock and assets is to donate them, so they continue to benefit the needs of the communities they were originally sent to help.

Potential receivers of asset donation (see order of preference to be followed above) should be contacted sequentially with donation offers, with a timeline within which they should respond. Beyond that timeline, the next option can be considered. Dates and offers of donations must be kept in writing.

Do they want them?

A list of the items available should be shared for potential receivers to pick from.

Can they use them?

Sophisticated and specialist equipment may require training before the receiver can autonomously use and maintain it.

Can they maintain them?

Certain items will require maintenance – can the receiver cover the cost?

Disposal by sale

Logistics are responsible for organising the disposal of assets by sale, after all the necessary approvals are obtained.

When selling items, a transparent system must be put in place, with a senior staff member overseeing the process. This could be through sealed-but-publicly-opened bids for higher value items or through a public, live auction with set prices for lower value items.

The following needs to be considered:

- The estimated sales value of the asset, and the administrative costs involved in a sale.

- If the exchange of asset in partial or full payment for replacement equipment or supplies is possible.

- If the destruction of the asset will be more economical or is required by law or by the nature of the property.

- If the interests of the British Red Cross will be better served by donation of the asset to a National Society or other humanitarian organisation, or transfer to another operational programme.

- If the asset is part of an operational programme, and if there are restrictions on the use of programme commodities and the desires of the donor.

- If there are governmental restrictions forbidding the sale of assets imported or requiring import duties to be paid prior to the sale of such goods.

- The public relations impact of such a sale.

- Taxes: if an item is brought into the country without paying tax, it must usually be paid if sold onwards within the country.

Sale of fixed assets should be performed on a sealed-bid basis, to obtain market value and ensure that the sale is both transparent and at “arm’s length” (with no possible interpretation of fraud or collusion). This is done by the following:

The sale of items or lots with a total value below £500 does not need to be performed by sealed bidding, and prospective buyers may be approached by telephone, letter or in person as well as through the media. After inspecting the asset, they may submit informal bids by phone, email, in writing or in person.

Competitive bidding. Invitations to bid for the purchase of assets are published in local media and issued to pre-identified prospective purchasers, and it is recommended that advertisements be published in the local media to encourage sales. The invitation to bid must specify whether augmented bids will be accepted after the opening of bids; if this is not specified, bidders should not be allowed to raise their bids after the official bid opening. If raising bids after the bid opening ceremony is allowed, bidders must be encouraged in their invitation to attend the sale in person and it must be made clear in the advertising and bidding documents that this will be an option.

Sale by fixed price may be recommended if the value of the property is known and the fixed price will ensure a fair return to the British Red Cross. However, it may be better to advertise for sealed bids, with the desired fixed price set as a minimum. This minimum set price should not be advertised however to allow opportunity for receipt of higher bids.

Note: the sale of assets to staff is usually not permitted. Should this be allowed as an exception, it must be a transparent process where all staff members have the opportunity to purchase.

Selling process

View and download a flowchart illustrating the selling process here.

Determining fair market value (FMV)

By broad definition, fair market value is the price that would be demanded and paid in a sale involving a willing seller under no compulsion to sell and a willing buyer under no compulsion to buy, assuming both have reasonable knowledge of the relevant facts about the asset.

Consult HQ logistics when there is a need to determine fair market value.

There are few options available to determine an asset’s current value:

- If the asset is insured, the finance team can request an appraisal from the insurance company.

- If the above is not possible, an independent authorised surveyor can be contracted to provide value of an asset, based on the standard practice in the specific country determined by law.

- In the case of vehicles or generators, the logistics team can request an appraisal from a vendor of second-hand/used cars/generators (preferably a dealer of the specific vehicle/generator), or from a local mechanic if neither are available. A minor fee is usually required for such appraisals.

Actions subsequent to sale

The asset register must be updated based on the bill of sale, with a copy of the bill of sale kept on file.

The organisation’s Insurance policy should be updated following the sale.

The proceeds of the sale must be reflected in the monthly accounts and incorporated as income to the programme for which the asset was utilised before being sold.

Disposal by public auction

Sales of items or lots of a total value above £500 to third parties are to be conducted by public auction or by submitting sealed bids. Sales are to be made to the highest bidder (subject to the reserve price being met). Exceptionally, local and international staff can bid on items but will have to place the highest bid to win them.

Proceeds from sale:

Income from the sale of assets funded by donors must be used as co-funding or according to donor guidelines.

The money received from the assets’ sale must be recorded in accounts as income and not set against the expenditure account.

Public sale with fixed prices:

Reserve prices should be set by a logistics coordinator, with validation from the head of delegation or country representative.

They should be roughly equal to prices found on the open market.

Disposal by destruction

Destruction of assets/inventory is subject to local environmental law and can be expensive.

Check for special authorisation from government, especially for the disposal of food, chemical items or dangerous goods found in assets (batteries, fluids, etc).

Recycling companies can be contracted to dispose of assets, though some costs may be incurred.

Writing off obsolete assets – UKO assets only

While stored in the UK, pre-positioned assets are largely managed as stock and kept on a balance sheet – items are purchased with logistics budget and reimbursed by users as they request the assets in stock.

When assets are broken or obsolete before they can be deployed, they must be written off and somehow “paid for”.

Logistics have some budget to cover write-off costs, but where assets have been damaged in use, the user’s team’s budget should cover the cost. A stock/asset write-off form must be completed and approved before the asset’s value can be written off the balance sheet.

The destruction or donation of obsolete assets should be budgeted for unless the asset has reached its 0-value due to depreciation.

Note: when an asset has been sold, its value can be offset against the proceedings of the sale without using funds from any other budget.

IT, communications, and data management assets specifics

An IT decommissioning policy does not currently exist within the British Red Cross. However, when disposing of any IT, communication or data management assets (such as computers, tablets, phones, GPS devices, radio sets and satellite phones), all the data stored on the device and all the parameters that were set up on it must be wiped off the device, applicable SIM cards removed and accounts closed.

In case of doubt, please contact the regional logistics coordinators so they can provide any necessary technical support.

Read the next section on Asset management and partners here.

Related resources

Download useful tools and templates here

Download the full section here.

Receiving an asset donation from a partner organisation, donor, commercial actor

No asset can be received without an asset donation certificate being raised (ideally by the donating party rather than the receiver, although the receiver can raise the receipt) and a GRN, signed by both parties.

The donation receipt must show all details relevant to the asset being donated, including:

- original purchase value

- current depreciated value

- origin (supplier, manufacturer)

- insurance requirements

- maintenance records.

The asset is tagged with a new number, per the numbering sequence maintained by the asset manager.

The asset is recorded on the asset register, with both the purchase value and the current depreciated value. It should be marked as a donation, with reference to the donation certificate or receipt number. Ideally, a donations tracker should be maintained and updated with any received donation.

The asset donation certificate should be kept on file.

After receiving a donated asset

- record asset receipt

- issue asset identification number

- tag asset

- record on asset register

- create asset file

- asset can be used.

Donating an asset to other organisations

No asset can be donated without a donation certificate being raised by the donating party and mutually signed. Note that the level of approval of the donation certificate will depend on the total amount of the donation.

| Donation amount | Approved by |

|---|---|

| Up to £50,000 | Budget holder (e.g. Programme/Country Manager) + Finance |

| Up to £100,000 | Head of department/head of region (LogCo consulted) |

| Up to £1,000,000 | Programmes & Partnership Director international |

| Up to £5,000,000 | Executive Director International |

| Above £5,000,000 | CEO and CFO (ELT informed) |

Refer to the Asset disposal section for more details.

Note: regardless of the total value of the asset donation, it is critical that the budget holder is informed in case an asset purchased with the budget they are responsible for is considered for donation.

Where applicable, ensure the donor has agreed to the asset donation. Depending on the donor, this may be through a formal submission of the asset disposal plan for approval and should be submitted through the relevant donor facing colleagues.

The donation certificate must show all details relevant to the asset being donated, including:

- purchase value

- current depreciated value

- origin (supplier, manufacturer, etc)

- insurance requirements

- maintenance records.

The donated asset must be kept on the asset register but marked as donated, with reference to the donation certificate number.

The asset tags and any other Red Cross visibility and data must be removed from the asset before it is physically transferred to the receiver.

Ensure that the applicable taxes are paid by the agreed party. Note: assets imported in a country on a tax-free basis often require payment of taxes at the time of donation. The receiver must be aware of all the costs associated to owning the asset (tax, registration, maintenance, etc.) and agree to cover the costs.

In the case of donating assets that are more sophisticated than those usually available in the country or region of donation, ensure that the receiver has been trained on the usage and maintenance of the asset, and that they understand that the donating party will accept no responsibility in case of harm or damages caused by the use of the asset.

Before donating an asset:

- Raise donation certificate.

- Obtain all approvals.

- Update asset status on asset register.

- Remove all identification or data from asset.

- Check applicable taxes.

- Inform recipient.

- Asset can be donated.

See guidance for asset disposal or transfer in the UK.

Ideally, a donations tracker should be maintained and updated with any donation to other organisations.

Read the next section on Asset disposal here.

Related resources

Download useful tools and templates here

Download the full section here.

Consumables/office supplies

Consumables don’t need to be taken as stock or assets, as their value is usually low. These include cleaning materials, stationery, lightbulbs, and other replacement items.

View and download a diagram illustrating how such items are managed here.

Equipment

Items that are worth less than £1,000, not powered by electricity, do not incur maintenance costs, have a useful life of less than 3 years, and are not defined as assets by the donor who funded their purchase, are classified as equipment and should be tracked on a property register.

Furniture, unless items worth more than £1,000 should be included on the property register rather than on the asset register.

Stocks

For the management of stocks, refer to the Warehousing chapter.

Read the next section on Procuring assets here.

Related resources

Download useful tools and templates here

Download the full section here.

To determine whether an item procured or received as Gift in Kind is an asset, stock, supply or piece of equipment, consult this diagram.

The below table defines the British Red Cross’ understanding of assets. Different partners may have different definitions (especially around the minimum value or useful life of an item), which will be stated in their own logistics or financial procedures.

| Stock | Office supplies | Equipment | Assets | |

|---|---|---|---|---|

| Definition | Consumable items tracked and stored until use/distribution | Temporary or disposable consumables, food or cleaning products for daily use in office or residence | <£1,000 Not powered by electricity No running costs Not defined as asset by donor | >£1,000 or > 3 years useful life or powered by electricity or incurs running cost or defined as asset by donor |

| Examples | Programme supplies for direct distribution Office supplies for distribution to beneficiaries, partners Vehicle spare parts, fuel | Stationary Office cleaning materials Food for office | Furniture Housing equipment Household items | Owned property Vehicles Comms equipment IT hardware Large household appliances |

| Reporting requirements | Stock report | None | Property register | Asset register |

| Storage location | Warehouse | In the office | In use or in storeroom* | In use or in storeroom* |

*The storeroom is typically a small room in the office where a small stock of office supplies is kept.

Available to download here.

In British Red Cross, asset management requirements are defined in the , together with any other specific requirements, whether they come from British Red Cross or from a donor (Section 6 in the standard GAD). Where it has been agreed that the partner will use their own asset management procedure, this requires prior approval and must be mentioned in the GAD.

One person from either logistics or finance must have operational responsibility for asset management, delegated from a country or programme manager.

In certain operations, assets may be managed at a programme or project level, but it is recommended that someone is allocated the task of centralising asset management (see above matrix for reference).

In large, multi-site operations, an asset manager should be hired to ensure compliant asset management. The task of asset management can be part of an existing role, such as logistics officer or finance officer, or exist as a standalone asset manager role.

Read the next section on Categories of assets here.

Download the full section here.

The 11 major rules of running a warehouse:

- Rotate stock so old goods are used first: FIFO (first in, first out). If goods have an expiry date, use FEFO (first expired, first out).

- Stack goods safely.

- Plan the layout of goods for easy access and finding them again.

- Record all movements or losses on the correct forms.

- File all papers immediately.

- Plan ahead: what goods, staff and transport will be required in the next day, week or month?

- Keep goods secure.

- Keep warehouse clean, with daily, weekly and monthly cleaning.

- Dispose of spoiled goods correctly and quickly.

- Communicate objectives, plans, progress and issues effectively.

- Conduct physical inventory on a regular basis.

Definition:

A warehouse is defined as a planned space for the storage and handling of goods and materials. Goods and materials stored in a warehouse are considered as stock, which is also called “inventory”. Warehouses are an integral part of the supply chain, their main purpose being to serve as physical transit points between supply (delivery from suppliers) and demand (end-users or beneficiaries).

Where needed, warehouses allow for the breakdown of bulk deliveries across different requestors or into phased deliveries, and for the combination of loose items into kits to meet beneficiaries’ needs.

A well-managed and well-positioned warehouse allows for speedy responses to both planned and unplanned needs and ensures that both inventory and staff are ready to respond to planned and unplanned needs.

Functions of a warehouse

View and download a detailed diagram of warehouse functions here.

Different types of inventory

It is important to be aware of the difference between stock (inventory), office supplies, office equipment and assets:

| Stock | Office supplies | Equipment | Assets | |

|---|---|---|---|---|

| Definition | Consumable items that are tracked and stored until use or distribution | Temporary or disposable consumables, food or cleaning products required on a day-to-day basis, for use in the office or residence | £1,000 or > 3 years useful life or Powered by electricity or Incurs running costs or Defined as asset by donor | |

| Examples | Programme supplies for direct distribution Office supplies for distribution to beneficiaries, partners Vehicle spare parts, fuel | Stationary Office cleaning materials Food for office consumption | Furniture Housing equipment Household items | Owned property Vehicles Comms equipment IT hardware Large household appliances |

| Reporting requirements | Stock report | None | Property register | Asset register |

| Storage location | Warehouse | In the office | In use or in storeroom* | In use or in storeroom* |

*The storeroom is typically a small room in the office where a small stock of office supplies is kept

Available to download here.

Purposes of holding stock

The main purpose of stock is to de-couple supply and demand in an operation that requires the provision of pre-determined goods and materials.

In an ideal world:

- exact needs are known

- suppliers are reliable

- supply is stable

- infrastructure is stable

- there is little to no need for inventory.

In the humanitarian world:

- needs fluctuate unpredictably

- suppliers are liable to multiple risks (environmental, political, financial)

- supply is often interrupted

- infrastructure is exposed to multiple risks (environmental, political, financial)

- inventory acts as a buffer against structural risks.

Stock ownership

Generally, stock is owned by its original requestor (the person who pays for the goods) and physical management of items and materials is delegated to logistics.

This means that logistics cannot choose to increase or decrease stocks unilaterally and that updates on inventory must be shared between the logistics team and the owners of the stock managed in the delegation.

In that sense, logistics is responsible for the inventory it holds for others, but requestors and programme managers are accountable for the type and quantity of items they require logistics to hold in stock for their use.

Stocks management – roles and responsibilities

RACI matrices are used throughout this manual. They break a process into steps, specifying who is Responsible, Accountable, Consulted and Informed at each step of the process.

| Responsible | Accountable | Consulted | Informed | |

|---|---|---|---|---|

| Warehousing & Stock Management | Warehouse staff | Requestor Budget holder | Programme team Health and safety | Logistics team Finance team |

Available to download here.

The valuation of inventory is critical for the organisation to manage the risk of ownership of stock in general, and in particular to support the definition of insurance requirements.

Financial management of stocks

For financial management of stock in the UK, refer to the Bulwick warehouse SOP, ERU kit SOP, UKO stock management SOP, RLU stock management SOP and the Balance sheet guidance note.

More information on the Regional Logistic Unit (RLU) and Emergency Response Unit (ERU) stocks management can also be found in the RLU stocks and ERUs chapters of the Manual.

The general concepts to bear in mind are:

- Inventory held by international logistics for preparedness purposes is valued in collaboration with the logistics finance business partner, based on procurement information shared by the logistics team.

- The value of inventory held by logistics sits on the British Red Cross balance sheet from the moment stock is received to the moment it is dispatched for use.

- When stock is dispatched for use, the value of the dispatched items is charged to its requestor and taken off the British Red Cross balance sheet.

- When stock needs to be disposed of, logistics must use a write-off form to record the disposal. The value of the disposed items is usually charged to the logistics budget and taken off the British Red Cross balance sheet.

See the Disposing of and writing off stocks and Writing off obsolete assets sections for more details on stock write-offs.

Note: it is recommended that the members of the logistics team who manage stock regularly meet with both their requestors and the finance team to review current stock type, levels and locations, discuss proposed changes (if any), ensure budget management and reconcile stock. In the British Red Cross, the logistics team meet with owners of the stock they manage (ERU kits, RLU representatives) and with their finance business partner on a regular basis.

Stock positioning

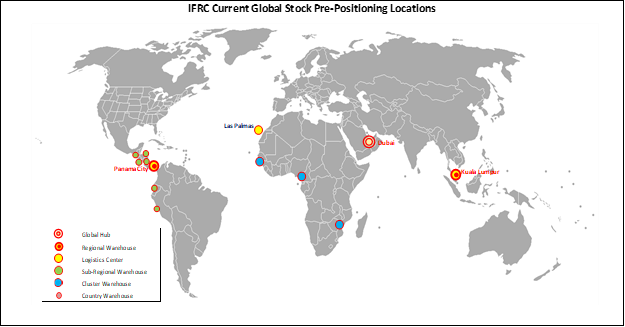

Within the Red Cross Movement, stocks are held at different levels and the processes to follow to access stock vary between levels of storage:

Country level

- This is stock that is available in country.

- Locally available stock can belong to the country’s or to a partner NS and would include the kits that a chooses to hold for -led responses.

- NS that do not hold ERUs may also have stocks available in country, either for ongoing programmes or for preparedness purposes.

Regional level

- This is stock that is held in regional hubs.

- In RLUs (Kuala Lumpur in Asia, Panama City in Americas), stocked by the IFRC and other PNSs and managed by the IFRC.

- In sub-regional warehouses or in decentralised regional stores (“cluster warehouses”), in Harare, Douala and Dakar.

Global level

- This is stock that is held in IFRC-managed global hubs.

- The Dubai and Las Palmas logistics centres are “global hubs”, serving all regions equally.

The IFRC’s global stock strategy aims are:

To cover the initial needs of the immediate aftermath of any disaster, the IFRC, with the stock pre-positioning of their members in the different RLU, has pre-positioned emergency response stockpiles in their network of regional warehouses across the globe, which could support up to 450,000 people at anytime and anywhere.

Read the next section on Building a stock strategy here.

Related resources

Download useful tools and templates