Handover, disposal, sale, donation

For details on the asset disposal process, refer to the Asset disposal section.

Vehicle Rental Programme-owned vehicles may only be disposed of following approval and instruction from the regional fleet coordinator or fleet base. When the vehicle’s disposal has been approved, the IFRC fleet management team will provide an asset disposal form.

Additional requirements when disposing of vehicles may include:

- Donor requirements must be fulfilled, including the approval to dispose of the vehicle, generator or handling equipment.

- All radio equipment and visibility items (stickers, paintings and other markings) must be removed from the vehicle prior to its disposal.

- License plates must be removed from the vehicle, and its buyer or receiver must source new plates by following the registration process.

- No vehicle may be sold to military, paramilitary or state-affiliated organisations.

- The disposal of vehicles by sale, donation or scrapping is usually strictly controlled by local authorities, and the procedures to follow will vary depending on the importation status of the vehicle (see the Vehicle registration process section of Vehicle usage for more details).

- A vehicle handover form and a certificate of de-registration must be completed, in addition to a transferral or cancellation of the insurance policy (and a donation certificate where applicable).

- All documentation relating to the donation or sale of the vehicle must be kept in its file.

Vehicles that have reached their end of life in IFRC criteria should not be sold or donated to a National Society.

| Type of vehicle | Distance to end of life | Age to end of life |

|---|---|---|

| Light vehicles | More than 125,000km | 5 years |

| Heavy goods vehicles | More than 300,000km | No age limit |

Vehicle disposal checklist

Where the vehicles are donated, the donation process detailed in the Donating an asset to other organisations section of Asset donations should be followed.

Where the asset disposal form suggests the sale of vehicles, step-by-step guidelines for the sale of vehicles by competitive bidding should be followed, using the templates provided for publication of the invitation to bid, the provision of bids and for the contract of sale and bill of sale.

Read the next section on Fleet audit trail here.

Related resources

Download useful tools and templates here

Download the full section here.

When closing down an office, operation or programme, all assets should be allocated a disposal option in an asset disposal plan that forms part of an overall exit plan of action.

The selection of options through the asset disposal plan is the responsibility of the budget holder (programme manager or country manager), implementation of the disposal plan is delegated to Logistics.

In order of preference, assets that need to be disposed of should be:

- Donated to the

- Donated to another RC Movement partner

- Donated to a partner

- Donated to another humanitarian organisation

- Sold

- Destroyed

Separate to these options, the option to export the asset back to the UK for further use should always be considered, based on the type of item, value and relevance in the local context. Consult the Logistics Coordinators to enquire about the relevance of returning an asset to the UK.

The budget holder must select the best option from the above list when creating the asset disposal plan.

The asset manager is responsible for managing the asset disposal process following the matrix in the Donating an asset to other organisations section of Asset donations. However, accountability for the process lies with the budget holder who must initiate the process, make the relevant decisions about each asset’s disposal and ensure all steps are followed properly through to sign-off of the disposal plan.

Designing the disposal plan:

Task:

- Confirm and compile list of assets and high-value stock as part of the exit plan of action (refer to the updated asset register).

Method:

- Physical check.

- Use the list to update status as the disposal process progresses.

- Propose list to for validation.

- The list must include damaged items and those that have already been pledged (which should be marked as such).

- The list must indicate purchase value, current depreciated value and donor codes.

Task:

- Consider donor/government requirements.

Method:

- Obtain guidance from donor and local government on asset disposal.

Task:

- Consider return, transfer or disposal options.

Method:

Committee at UKO to be constituted (can include members from logistics, finance, IT and programme team and donor representation) to agree disposal route:

- export to return to UK

- transfer to other programme locally (British Red Cross, HNS, consortium)

- donation

- sale

- destruction

- committee to consider donor requirements, Value for money, repair options and costs, on-going maintenance/running costs (potentially impacting the HNS adversely) and cost of repatriation (including carbon footprint analysis).

Implementing the disposal plan:

Task:

- Donation to HNS, , or other NGO. Note: donation to staff is strictly prohibited.

Method:

- Communicate the asset list to organisations to see if anything within the list is needed for their programme.

- British Red Cross need to ensure that assets will be used and should consider what other PNS will do to reduce the risk of overwhelming the HNS with assets.

- Confirm with local legal advisor that there is no problem transferring assets under the IFRC Integration Agreement.

- Donation certificate will be required.

Task:

- Sale.

Method:

- Bill of sale must be raised, signed by each party.

- Depending on quantity of items to be sold, consider contracting a company to manage the sale.

- Tax implications of sale must be carefully researched.

- Proceeds of the sale must adhere to donor requirements.

Task:

- Destruction.

Method:

- Consider local environmental law and associated costs and requirements (especially for dangerous goods and fluids).

- Consider contracting recycling companies and associated costs and donor requirements.

Task:

- Export back to UK.

Method:

- Costs must be investigated and approved by UKO committee.

Reporting losses: all lost or stolen assets should be recorded on the frauds and losses register as they occur. British Red Cross requires all asset losses to be reported through Datix incident management system.

Damaged assets must be identified as such – logistics must be consulted on repair options and arrange for agreed repairs.

The overall exit plan of action, and the asset disposal plan in particular, must be signed off according to the total value (that is, the purchase value, not the depreciated value) of the portfolio of items/assets being disposed of following the thresholds listed below and signed off in the if there is one.

| Donation amount | Approved by |

|---|---|

| Up to £50,000 | Budget holder (e.g. Programme/Country Manager) + Finance |

| Up to £100,000 | Head of department/head of region (LogCo consulted) |

| Up to £1,000,000 | Programmes & Partnership Director international |

| Up to £5,000,000 | Executive Director International |

| Above £5,000,000 | CEO and CFO (ELT informed) |

Note: regardless of the total value of the asset disposal plan, it is critical that the budget holder (programme manager or country manager) is informed at all stages of development of the plan.

Note: the sequence of approvals is important for asset disposal plans:

- if there is one

- BRC per the above table

- donor

Once the asset disposal plan has been finalised, it should be circulated to the designated approvers, together with an asset disposal plan sign-off form.

Disposal by donation

The preferred option for disposing of surplus stock and assets is to donate them, so they continue to benefit the needs of the communities they were originally sent to help.

Potential receivers of asset donation (see order of preference to be followed above) should be contacted sequentially with donation offers, with a timeline within which they should respond. Beyond that timeline, the next option can be considered. Dates and offers of donations must be kept in writing.

Do they want them?

A list of the items available should be shared for potential receivers to pick from.

Can they use them?

Sophisticated and specialist equipment may require training before the receiver can autonomously use and maintain it.

Can they maintain them?

Certain items will require maintenance – can the receiver cover the cost?

Disposal by sale

Logistics are responsible for organising the disposal of assets by sale, after all the necessary approvals are obtained.

When selling items, a transparent system must be put in place, with a senior staff member overseeing the process. This could be through sealed-but-publicly-opened bids for higher value items or through a public, live auction with set prices for lower value items.

The following needs to be considered:

- The estimated sales value of the asset, and the administrative costs involved in a sale.

- If the exchange of asset in partial or full payment for replacement equipment or supplies is possible.

- If the destruction of the asset will be more economical or is required by law or by the nature of the property.

- If the interests of the British Red Cross will be better served by donation of the asset to a National Society or other humanitarian organisation, or transfer to another operational programme.

- If the asset is part of an operational programme, and if there are restrictions on the use of programme commodities and the desires of the donor.

- If there are governmental restrictions forbidding the sale of assets imported or requiring import duties to be paid prior to the sale of such goods.

- The public relations impact of such a sale.

- Taxes: if an item is brought into the country without paying tax, it must usually be paid if sold onwards within the country.

Sale of fixed assets should be performed on a sealed-bid basis, to obtain market value and ensure that the sale is both transparent and at “arm’s length” (with no possible interpretation of fraud or collusion). This is done by the following:

The sale of items or lots with a total value below £500 does not need to be performed by sealed bidding, and prospective buyers may be approached by telephone, letter or in person as well as through the media. After inspecting the asset, they may submit informal bids by phone, email, in writing or in person.

Competitive bidding. Invitations to bid for the purchase of assets are published in local media and issued to pre-identified prospective purchasers, and it is recommended that advertisements be published in the local media to encourage sales. The invitation to bid must specify whether augmented bids will be accepted after the opening of bids; if this is not specified, bidders should not be allowed to raise their bids after the official bid opening. If raising bids after the bid opening ceremony is allowed, bidders must be encouraged in their invitation to attend the sale in person and it must be made clear in the advertising and bidding documents that this will be an option.

Sale by fixed price may be recommended if the value of the property is known and the fixed price will ensure a fair return to the British Red Cross. However, it may be better to advertise for sealed bids, with the desired fixed price set as a minimum. This minimum set price should not be advertised however to allow opportunity for receipt of higher bids.

Note: the sale of assets to staff is usually not permitted. Should this be allowed as an exception, it must be a transparent process where all staff members have the opportunity to purchase.

Selling process

View and download a flowchart illustrating the selling process here.

Determining fair market value (FMV)

By broad definition, fair market value is the price that would be demanded and paid in a sale involving a willing seller under no compulsion to sell and a willing buyer under no compulsion to buy, assuming both have reasonable knowledge of the relevant facts about the asset.

Consult HQ logistics when there is a need to determine fair market value.

There are few options available to determine an asset’s current value:

- If the asset is insured, the finance team can request an appraisal from the insurance company.

- If the above is not possible, an independent authorised surveyor can be contracted to provide value of an asset, based on the standard practice in the specific country determined by law.

- In the case of vehicles or generators, the logistics team can request an appraisal from a vendor of second-hand/used cars/generators (preferably a dealer of the specific vehicle/generator), or from a local mechanic if neither are available. A minor fee is usually required for such appraisals.

Actions subsequent to sale

The asset register must be updated based on the bill of sale, with a copy of the bill of sale kept on file.

The organisation’s Insurance policy should be updated following the sale.

The proceeds of the sale must be reflected in the monthly accounts and incorporated as income to the programme for which the asset was utilised before being sold.

Disposal by public auction

Sales of items or lots of a total value above £500 to third parties are to be conducted by public auction or by submitting sealed bids. Sales are to be made to the highest bidder (subject to the reserve price being met). Exceptionally, local and international staff can bid on items but will have to place the highest bid to win them.

Proceeds from sale:

Income from the sale of assets funded by donors must be used as co-funding or according to donor guidelines.

The money received from the assets’ sale must be recorded in accounts as income and not set against the expenditure account.

Public sale with fixed prices:

Reserve prices should be set by a logistics coordinator, with validation from the head of delegation or country representative.

They should be roughly equal to prices found on the open market.

Disposal by destruction

Destruction of assets/inventory is subject to local environmental law and can be expensive.

Check for special authorisation from government, especially for the disposal of food, chemical items or dangerous goods found in assets (batteries, fluids, etc).

Recycling companies can be contracted to dispose of assets, though some costs may be incurred.

Writing off obsolete assets – UKO assets only

While stored in the UK, pre-positioned assets are largely managed as stock and kept on a balance sheet – items are purchased with logistics budget and reimbursed by users as they request the assets in stock.

When assets are broken or obsolete before they can be deployed, they must be written off and somehow “paid for”.

Logistics have some budget to cover write-off costs, but where assets have been damaged in use, the user’s team’s budget should cover the cost. A stock/asset write-off form must be completed and approved before the asset’s value can be written off the balance sheet.

The destruction or donation of obsolete assets should be budgeted for unless the asset has reached its 0-value due to depreciation.

Note: when an asset has been sold, its value can be offset against the proceedings of the sale without using funds from any other budget.

IT, communications, and data management assets specifics

An IT decommissioning policy does not currently exist within the British Red Cross. However, when disposing of any IT, communication or data management assets (such as computers, tablets, phones, GPS devices, radio sets and satellite phones), all the data stored on the device and all the parameters that were set up on it must be wiped off the device, applicable SIM cards removed and accounts closed.

In case of doubt, please contact the regional logistics coordinators so they can provide any necessary technical support.

Read the next section on Asset management and partners here.

Related resources

Download useful tools and templates here

Download the full section here.

Stock that is not used by its owner should be donated or disposed of, depending on the context and on the quality of the items. In either case, the stock movement must be recorded like any other, and the value of stock transferred must come off the inventory. Stocks owned by the British Red Cross are written off, i.e. taken off the logistics balance sheet.

The British Red Cross has determined the following priority order, through which asset/inventory disposal must be executed:

- Donation to

- Donation to Movement

- Donation to local partner

- Donation to another humanitarian actor

- Sale

- Destruction

Donation to staff is strictly prohibited, though staff and volunteers are permitted to bid on items which are on sale.

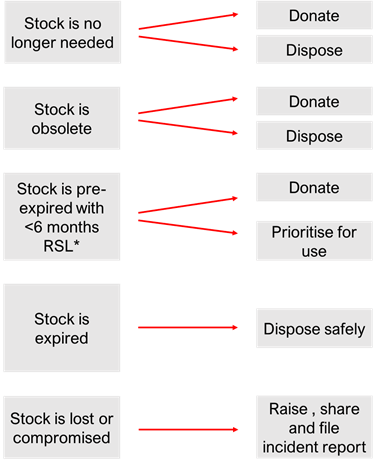

There are various reasons to write stock off:

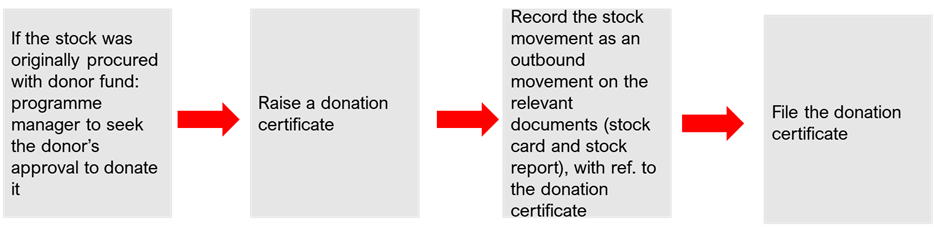

Donating stock

Before donating stock, make sure that:

The prospective receiver wants the items -> ask: “Do you want the items?”

The prospective receiver can safely use the items -> ask: “Can you provide guarantees that you have the means to use and control the items safely?”

A donation can be made to a partner organisation or to a separate project within the same organisation, though it is then more of a transfer.

In all cases, the process to follow is the same:

The donation certificate:

- Must include at least an estimate of the total value of the donated items.

- Must be approved as per the approval matrix: the higher the value of the items donated, the more senior the approver – follow guidance in the Registering assets section of the Assets chapter.

- Must be signed by the stock owner (programme manager) and the receiving organisation/partner.

Finance must be informed of the value of the donated or transferred stock so they can reallocate the values accordingly. Ideally, the total value of donated stock must be communicated to finance on at least a yearly basis, through a donation report.

When receiving donated stock, the donating partner or programme must raise the donation certificate, and the receiver of the donation must record the quantity as an inbound stock movement. The total value of received stock must be reported on a similar basis as the donated stock. See stock donation tracker format. The format must be used for recording asset and stock donations – see the Assets chapter for more details on asset donations.

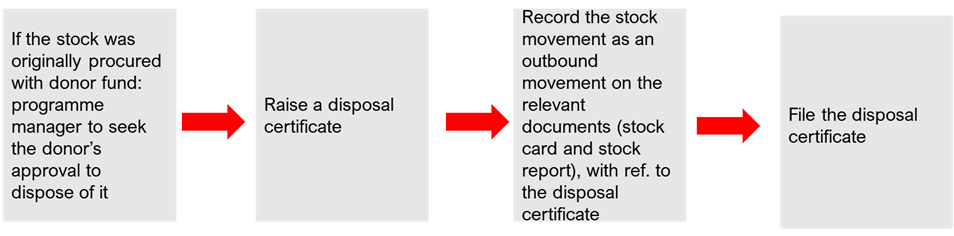

Disposing of stock

Disposing of stock means destroying it and should be a last resort. Where stock is disposed of, this must be done in a safe and legally compliant way.

The process to follow is:

The disposal certificate must:

- include at least an estimate of the total value of the disposed items

- be approved as per the approval matrix: the higher the value of the items disposed of, the more senior the approver – follow guidance in the Registering assets section of the Assets chapter

- be signed by the stock owner (programme manager) and the receiving organisation/partner.

Finance must be informed of the value of the disposed stocks, so they can write its value off accordingly. Ideally, the total value of disposed stock must be communicated to finance on at least a yearly basis, through a donation report.

When disposing of food items, medical supplies, dangerous goods or chemicals, it is recommended to liaise with the appropriate local authorities to understand the rules that apply. Where destruction is required, it must be documented by a destruction certificate, signed by the disposing of the stock and the authority overseeing the destruction. Note that authorities usually charge a fee for destruction.

If stock is returned to the UK damaged or if items in stock in the UK or in any of the global warehouses expire (e.g., water purification drops, first aid kit), they must be written off in a stock write-off form, in which the logistics officer must justify the reasons for the write-off and propose options for dealing with the stock which could include:

- Donating items (e.g., to shops or UK operations). If items or equipment are in good condition and have resale potential, contact the eBay manager in retail who will consider them for posting on eBay.

- Recycling or disposing items. Radios, satellite phones and electronics need to be disposed of properly and the TA should contact IT or a supplier to dispose of items properly.

The logistics officer documents different options, stating the preferred option in the recommendation section and gets this signed off by the head of logistics.

When the form is signed, the logistics officer gets this agreed or written off by finance and actions the agreed outcome.

Note: additional funds will need to be requested for higher value asset write-offs, as they are deducted from logistics management’s budget.

Recording a stock loss or theft

An incident report must be completed when stock is stolen or lost to damage, destruction or bad management, where the total value of the loss is above £100.

The incident report must be raised by the warehouse staff in charge of the stock, with proposed follow-up actions reviewed by the Logistics delegate and approved by the logistics coordinator. The incident report must specify the estimated value of the total loss.

Where the incident report is raised to report on stocks held in , Bulwick or in the ’s , the incident report must be prepared by the logistics officer, reviewed by the logistics manager and approved by head of logistics and international finance. See SOPs for more details on these procedures.

The quantities declared as lost must be reported on the stock card and report, with reference to the incident report.

Read the next section on Health and safety in the warehouse here.

Related resources

Download useful tools and templates